From 6th April 2020, company car drivers will no longer pay benefit-in-kind (BIK) tax on electric cars.

This new initiative is part of the government’s continued efforts to encourage the transition to low emission and electric vehicles. The new tax reductions and exemptions mean that businesses who provide emissions-free, electric company cars will pay no BIK tax rate in 2020/21.

Company car fleets contribute to almost six in 10 new car registrations in the UK. However, the updated measures will incentivise the UK’s one million company car drivers to shift to electric, cleaner, more environmentally-friendly models that produce far less Co2 emissions.

What Are BIKs?

Not to be confused with income tax, Benefits in Kind (BIKs) are the perks people receive from their employment that aren’t included in their salary or wage packet. Examples of Benefits in Kind can include company cars and private medical insurance.

Some of these are already tax-free: such as the contributions paid by an employer into your approved occupational or personal pension scheme. However, Benefits in Kind for company cars are taxed.

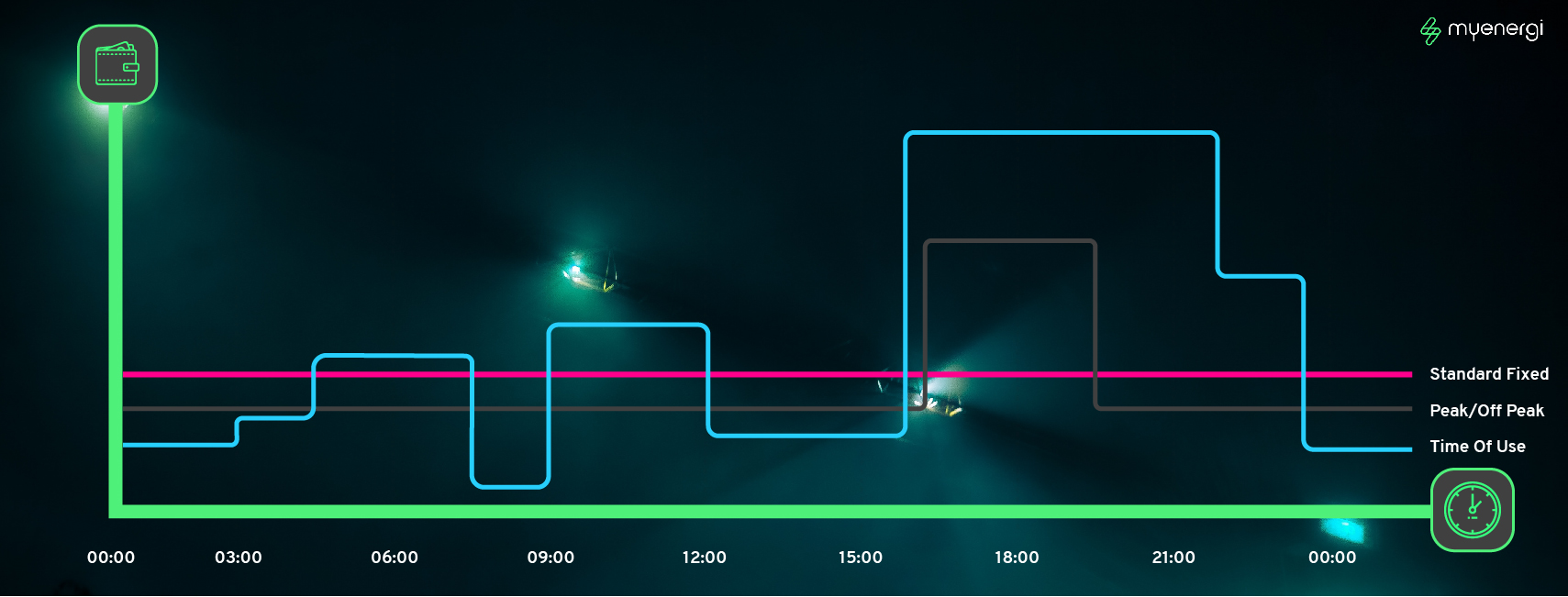

Your BIK rate, which usually covers the tax year depending on how you choose to pay it, is based on the emissions the car produces and how much it costs.

Company car drivers who go electric will pay absolutely zero BIK tax from April 2020, thus presenting yet another huge advantage of joining the electric revolution!

No BIK: How Will This Work?

Her Majesty’s Treasury has created two new BIK tables for company car drivers. One table is for those driving a company car registered after April 6, 2020, and one is for those driving a company car registered before April 6, 2020.

The Treasury says that for cars first registered from April 6, 2020, most company car tax rates will be reduced by two percentage points. That means for a pure electric vehicle with zero tailpipe emissions, company car drivers will be taxed at 0%: paying no BIK tax at all.

The zero percentage rate also applies to company car drivers in electric vehicles registered before April 6, 2020, who were already receiving a reduced rate of 2% for 2020/21.

Pure electric company cars registered before April 6, 2020, will also increase to 1% and 2% in subsequent years, from 2021/22 to 2022/23.

Does the 0% BIK include Hybrid Cars?

It’s not only electric vehicles that will be exempt from BIK in 2020 – plug-in hybrid cars are also included in the zero company car tax rate.

Plug-in hybrid models need to officially emit less than 50 grams per kilometre of CO2 and be able to travel for at least 130 miles as a pure electric vehicle to be eligible. Hybrid company car drivers will also benefit from zero BIK tax from April 6 2020, rising to one per cent and two per cent in subsequent years.

Fortunately, there are tax breaks for drivers of hybrid models with shorter electric-only ranges. Plug-in hybrids with an official electric range of less than 30 miles will be subject to 12 per cent BIK from April next year, which is still less than a conventional combustion engine.

How Will This Affect Us?

This is a milestone event for the EV industry and for businesses over the country as there are now real and measurable incentives to make the transition to electric or hybrid engines.

By providing the appropriate percentages, the Government claims that “businesses will have the ability to make more informed decisions about how they make the transition to zero emission fleets”.

This development is an exciting step in the right direction for our country’s efforts to tackle climate change, which is at the heart of everything we do at myenergi. By making electric vehicles the new normal we’re taking the climate crisis into our own hands, whilst paving the way for renewable energy technology to flourish.

libbi

libbi